BANK OF INDIA Arbitrage Fund Regular Growth

Invest Now

Fund Manager: Mr. Firdaus Ragina |

Hybrid: Arbitrage |

NIFTY 50 Arbitrage TRI

NAV as on 16-01-2026

AUM as on

Rtn ( Since Inception )

4.73%

Inception Date

Jun 05, 2018

Expense Ratio

0.94%

Fund Status

Open Ended Scheme

Min. Investment

5,000

Min. Topup

1,000

Min. SIP Amount

1000

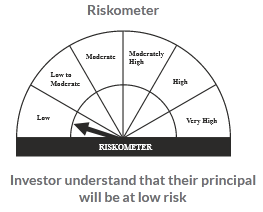

Risk Status

low

Investment Objective : The Scheme seeks to generate income through arbitrage opportunities between cash and derivative segments of the equity market and arbitrage opportunities within the derivative segment and by deployment of surplus cash in debt securities and money market instruments. However, there is no assurance or guarantee that the investment objective of the scheme will be realized